Empower Your Underwriters and Sales Specialists with the Smart System

Your team is only as effective as the system they are working with. DataHub reduces admin load, enhances compliance, integrates data, and manages complex plans – to drive optimal performance.

The Real Cost of Traditional Underwriting

Group health underwriting is stuck in the past. Manual processes and fragmented data make it harder to evaluate modern workforces, price risks accurately, and deliver competitive quotes quickly. It’s time for a Smarter approach to underwriting.

Modern Workforce Challenges

75% of employers have adopted hybrid work models, complicating the assessment of employee health risks. (Archie)

Underwriters spend 30% of their time on manually executing analyses. (Unqork)

3x the complexity in underwriting is caused by multi-state compliance requirements. (Wolter Kluwer)

Time Lost to Manual Work

40% of the underwriter's time is spent on non-core activities such as data entry and administrative tasks. (Accenture)

80% of underwriting teams report that paperwork-related inefficiencies negatively impact client satisfaction. (Insurance Business America)

Process Visibility & Compliance

62% of underwriters struggle to effectively track case statuses, leading to inefficiencies. (Insurance Thought Leadership)

18% increase in compliance exposure occurs due to process inefficiencies. (KPMG)

30% of underwriting decisions are made with incomplete information, increasing the likelihood of errors. (Accenture)

Complex Underwriting Processes

50% slower processes occur with traditional underwriting compared to automation. (Inrule)

3%-5% revenue loss happens due to proposal delays. (QurousDocs)

40% of teams face pricing accuracy issues with outdated processes. (FormAssembly)

Data Integration Challenges

60% of underwriters lack a comprehensive view of group risk due to fragmented data systems. (International Insurance)

80% of underwriters report significant delays in decision-making due to the lack of seamless data integration between different internal and external systems. (Visvero)

Intelligent Automation

That Powers Faster, Smarter Underwriting

Transform your group health underwriting from complex to confident. DataHub unifies scattered data, automates manual work, and gives your team real-time insights in one powerful platform. Built for today’s distributed workforce and evolving healthcare landscape, it empowers underwriters to make faster, smarter decisions and deliver the responsive service modern groups expect.

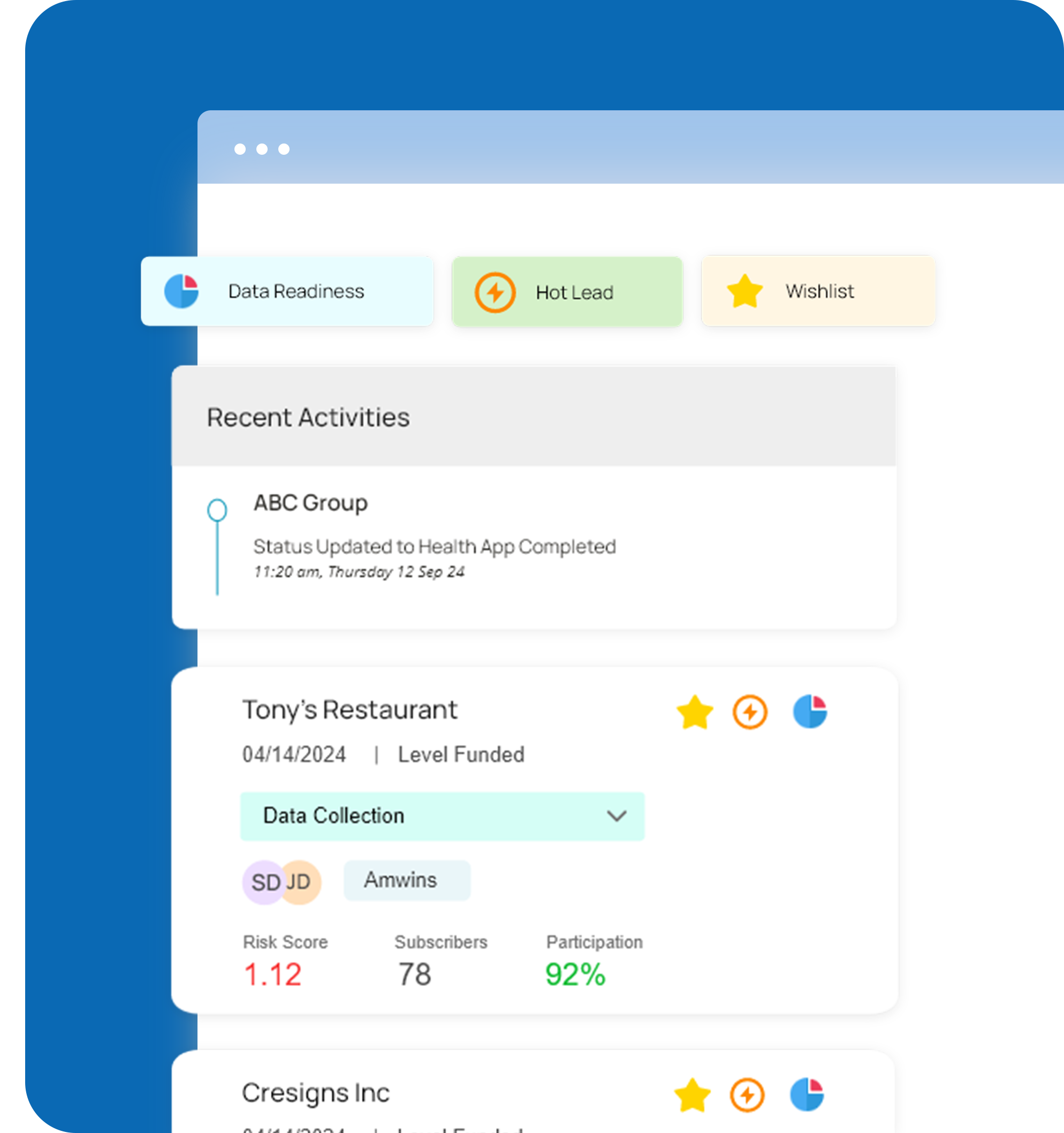

Smarter Workflow Starts Here

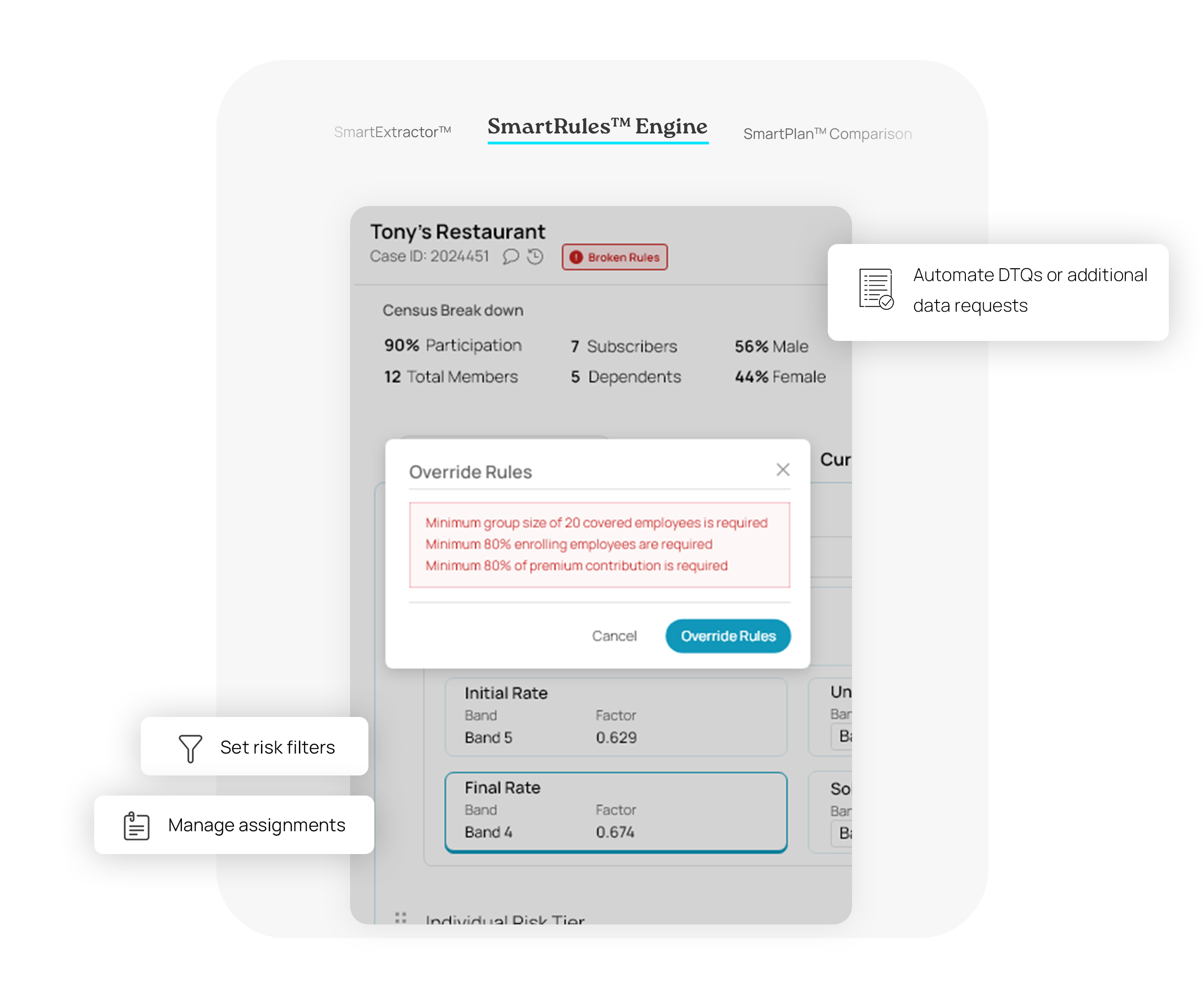

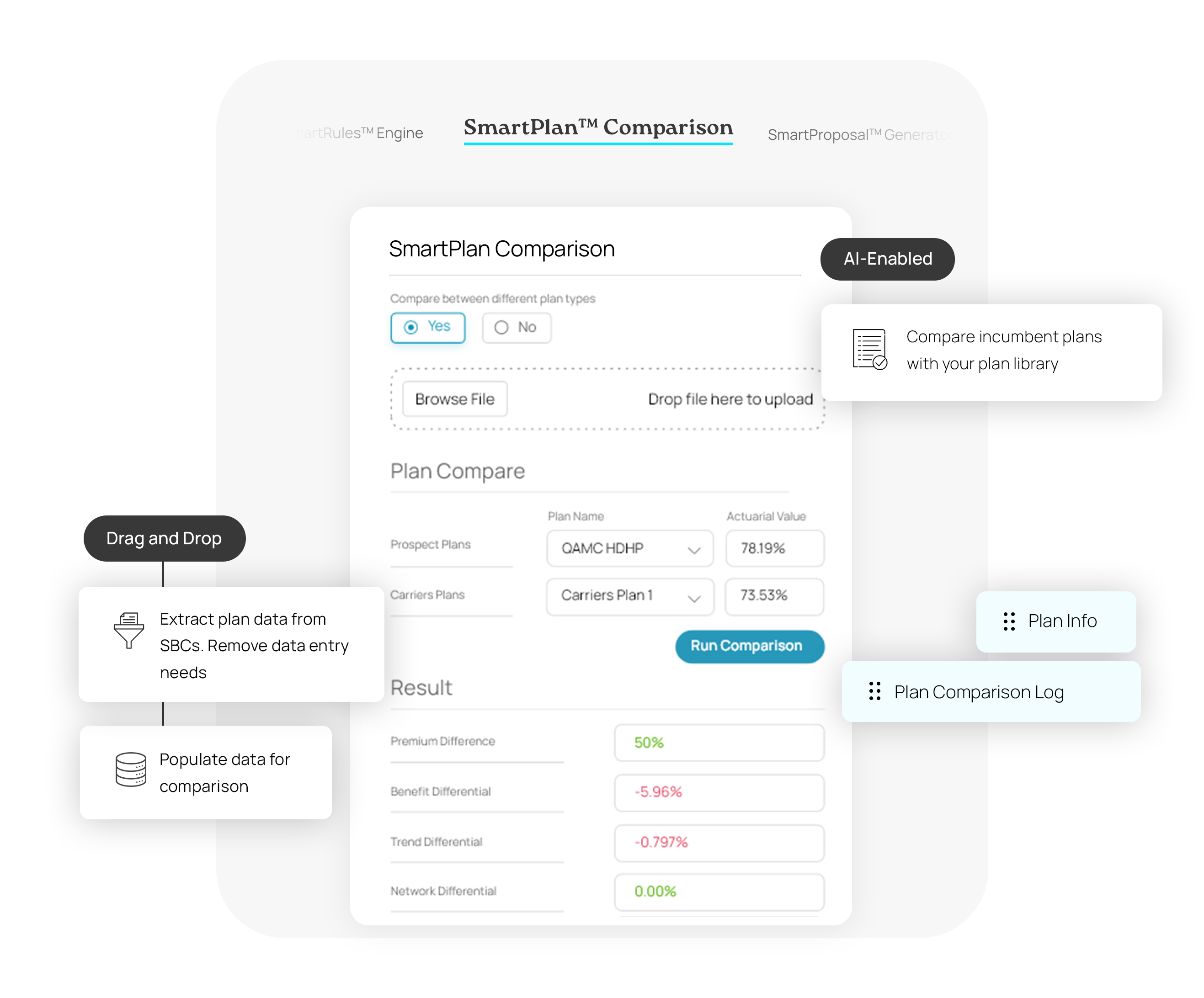

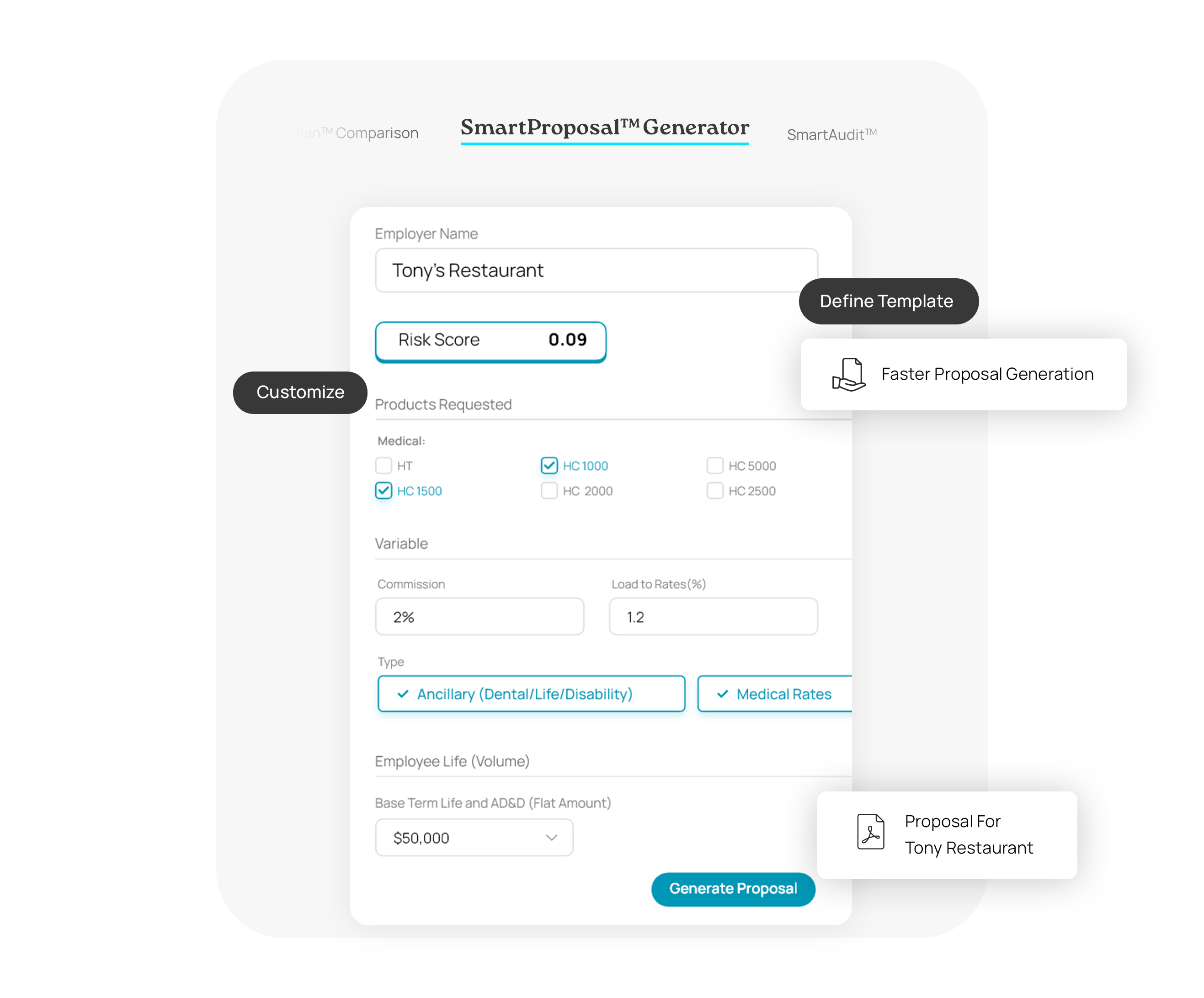

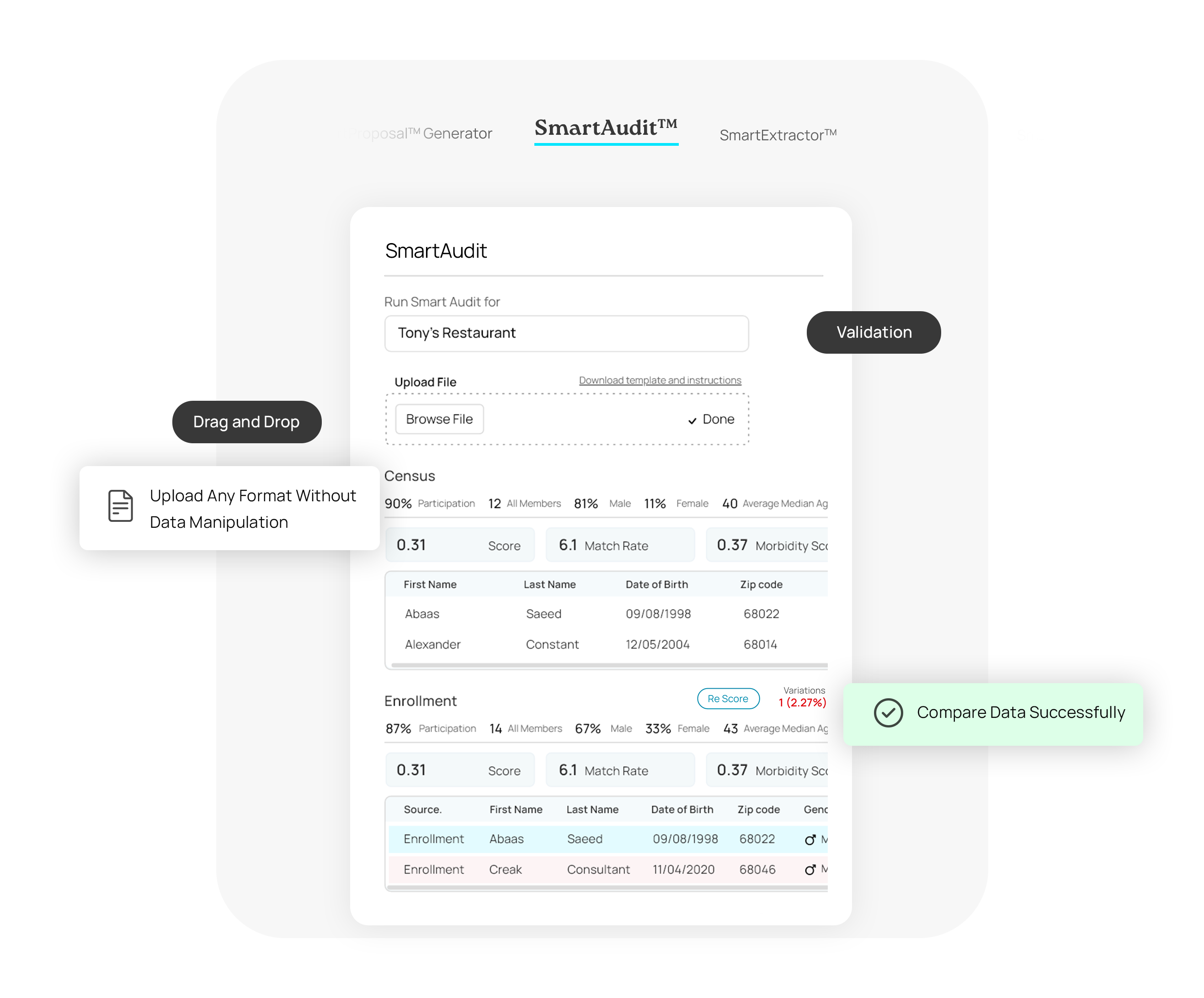

DataHub gives your underwriters and sales specialists a single platform to access, integrate and manage complex data with ease.

Who We Serve

Health Plans

From underwriting to sales, employee benefits carriers face unique challenges in managing complex plans and ensuring timely, accurate service. DataHub helps carriers streamline workflows, improve collaboration, and scale operations—all while enhancing client satisfaction.

Association Health Plans

Managing complex group health plans for diverse member organizations is no small feat. DataHub simplifies workflows, automates manual processes, and integrates data to empower MEWAs and AHPs to deliver exceptional service with efficiency and accuracy.

Stop Loss

Stop loss carriers and MGUs face unique challenges in managing high volumes of complex claims and underwriting. DataHub simplifies processes, integrates fragmented data, and enhances risk assessment, enabling teams to deliver faster, more accurate decisions while improving client satisfaction.

PEOs

PEOs face the dual challenge of managing employee benefits for diverse client organizations while mitigating compliance and risk exposure. DataHub simplifies these complexities with smart automation, data integration, and intuitive tools to streamline workflows, enhance accuracy, and deliver exceptional client service.

DataHub Impact

Efficiency

80%

Reduction in data entry errors

50%

Faster underwriting process

30%

Less administrative time

Scale

50,000+

RFPs processed

25,000+

Members underwritten

5

Integration options

Quality

100%

Unified data view

60%

Better case tracking

40%

Improved decision quality

Security

Security

Ease of Use

No IT Overhead for low cost of ownership

“DataHub, has been a trusted partner to GradientAI, working together to enhance systems and processes for their carrier clients. Our collaborative solutions have streamlined operations, delivering efficiency and value that benefit GradientAI’s clients directly.”

Ryan Braden

Director of Sales at Gradient AI

Get Started Today

Equip your underwriters and sales specialists with a system built for their success. Schedule a demo today and see how DataHub can drive optimal performance for your team.