Empowering Association Health Plans to Navigate the Shift to Alternative Funding

Association Health Plans (AHPs) and MEWAs are at the forefront of the transformation in group benefits, as businesses move away from fully insured arrangements toward alternative funding solutions. DataHub provides the tools to streamline this transition, enabling seamless interactions between brokers, payers, and member organizations to deliver exceptional service with efficiency and accuracy.

How AHPs Are Driving Change

As traditional fully insured arrangements become less appealing due to rising costs and limited flexibility, many employers are turning to alternative funding mechanisms, such as level-funded or self-funded plans, often using the framework of Association Health Plans. These plans pool member organizations together to leverage collective buying power while tailoring benefits to meet the specific needs of their members.

However, the complexity of managing multiple member groups, diverse plan requirements, and compliance across states can create significant challenges. Tools like DataHub are helping AHPs and MEWAs streamline operations and adapt to this evolving landscape.

Challenges AHPs and MEWAs Face

Complex Underwriting and Quoting

Tailoring quotes and benefit plans to diverse member organizations demands robust systems and workflows.

Manual processes lead to slower turnaround times and a higher likelihood of errors.

Compliance and Transparency

Multi-state regulations and compliance requirements are intricate and time-consuming to manage.

Limited visibility into case statuses and incomplete information complicate risk assessments.

Fragmented Data Systems

Managing data from diverse member organizations often leads to inconsistencies and inefficiencies.

A lack of centralized systems creates delays and increases administrative workloads.

Member Retention Challenges

Delays, inaccuracies, and limited transparency in plan offerings can erode trust and member satisfaction.

Key Features Designed for AHPs and MEWAs

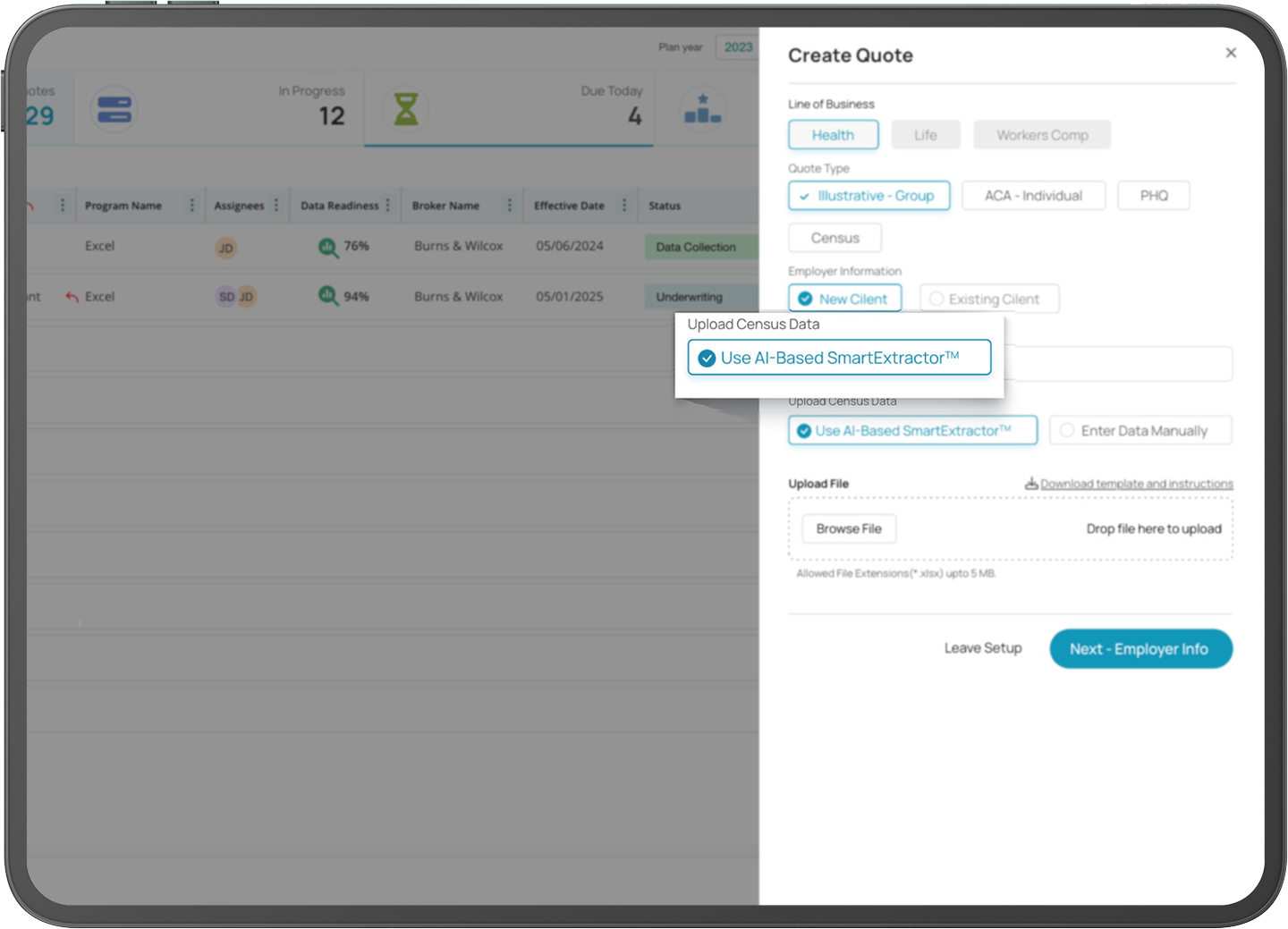

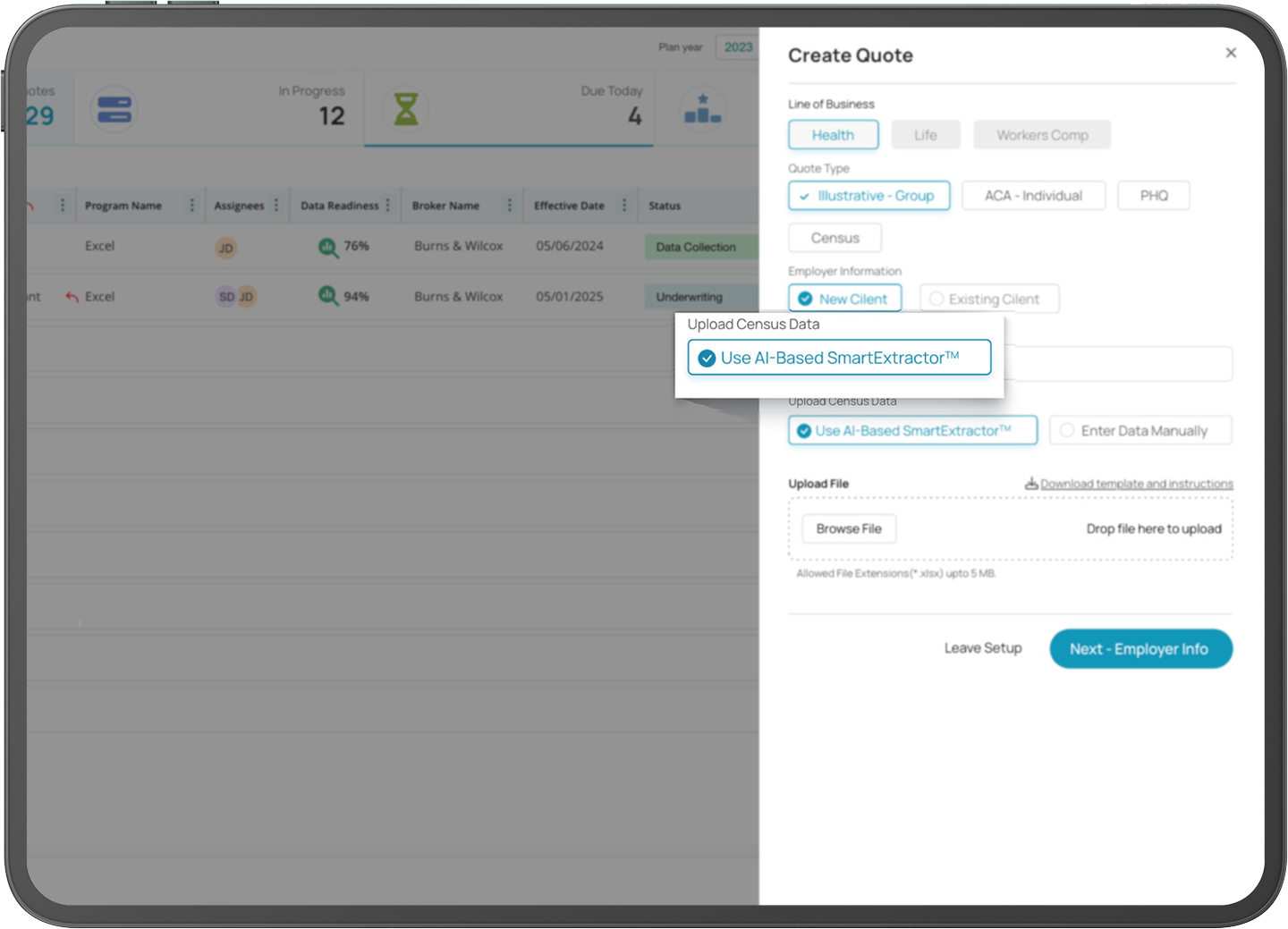

SmartExtractor™

Automates census and claims data extraction from various formats, ensuring data accuracy and consistency.

Automates census and claims data extraction from various formats, ensuring data accuracy and consistency.

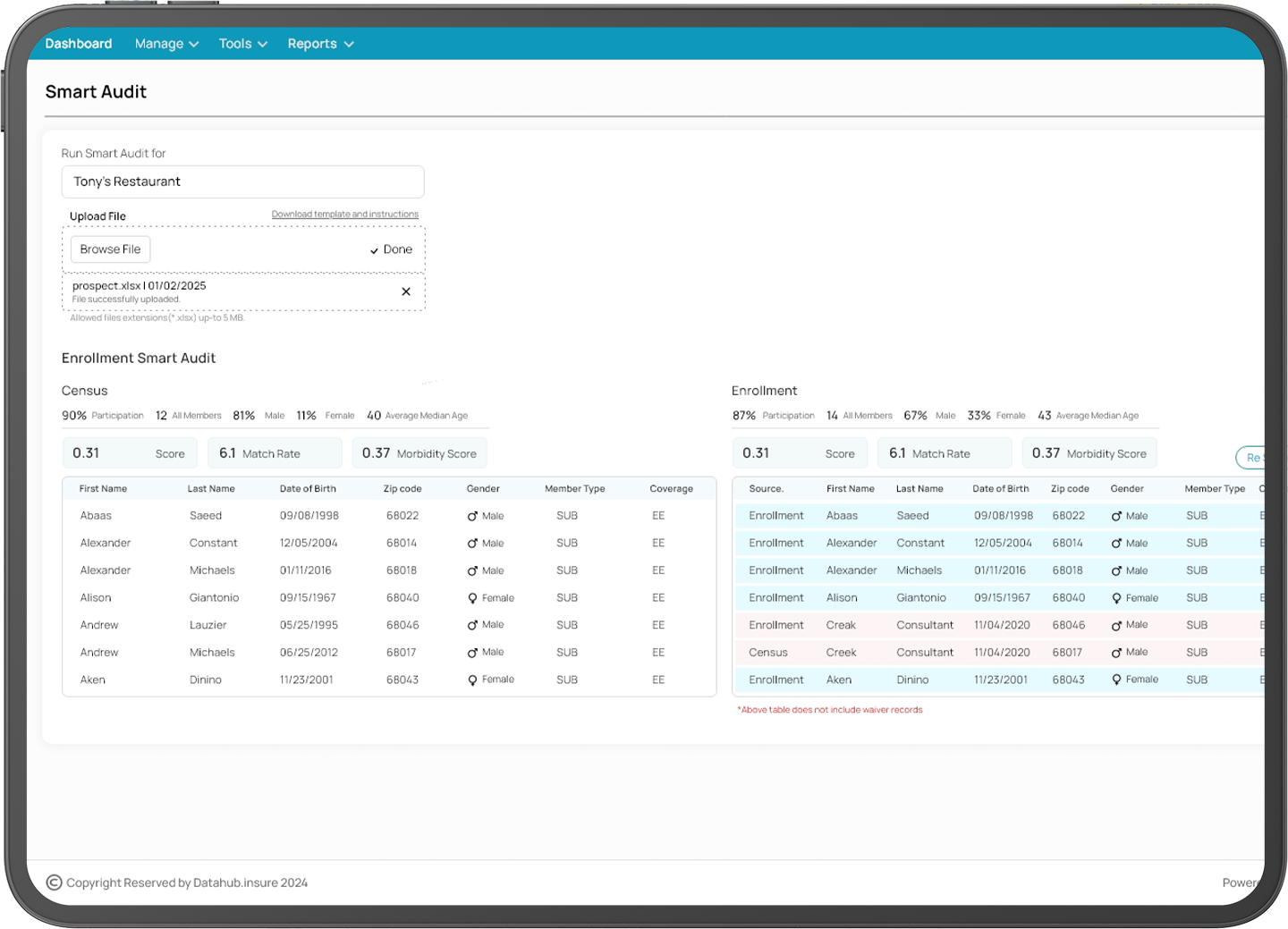

SmartAudit™

Built-in compliance monitoring to navigate complex multi-state regulatory frameworks.

Built-in compliance monitoring to navigate complex multi-state regulatory frameworks.

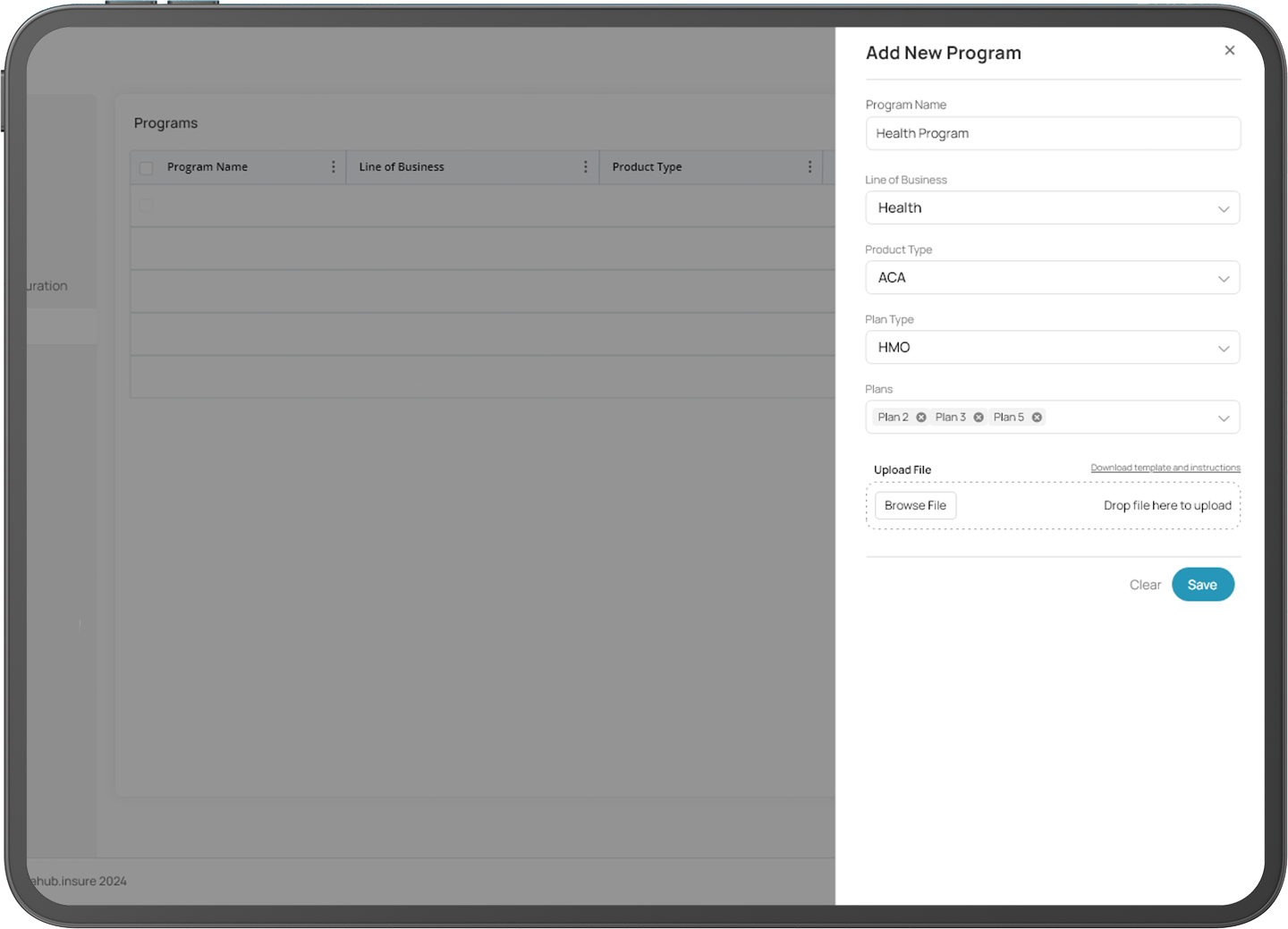

Portfolio Management

Manage multiple member groups and plans within one platform, reducing administrative overhead.

Manage multiple member groups and plans within one platform, reducing administrative overhead.

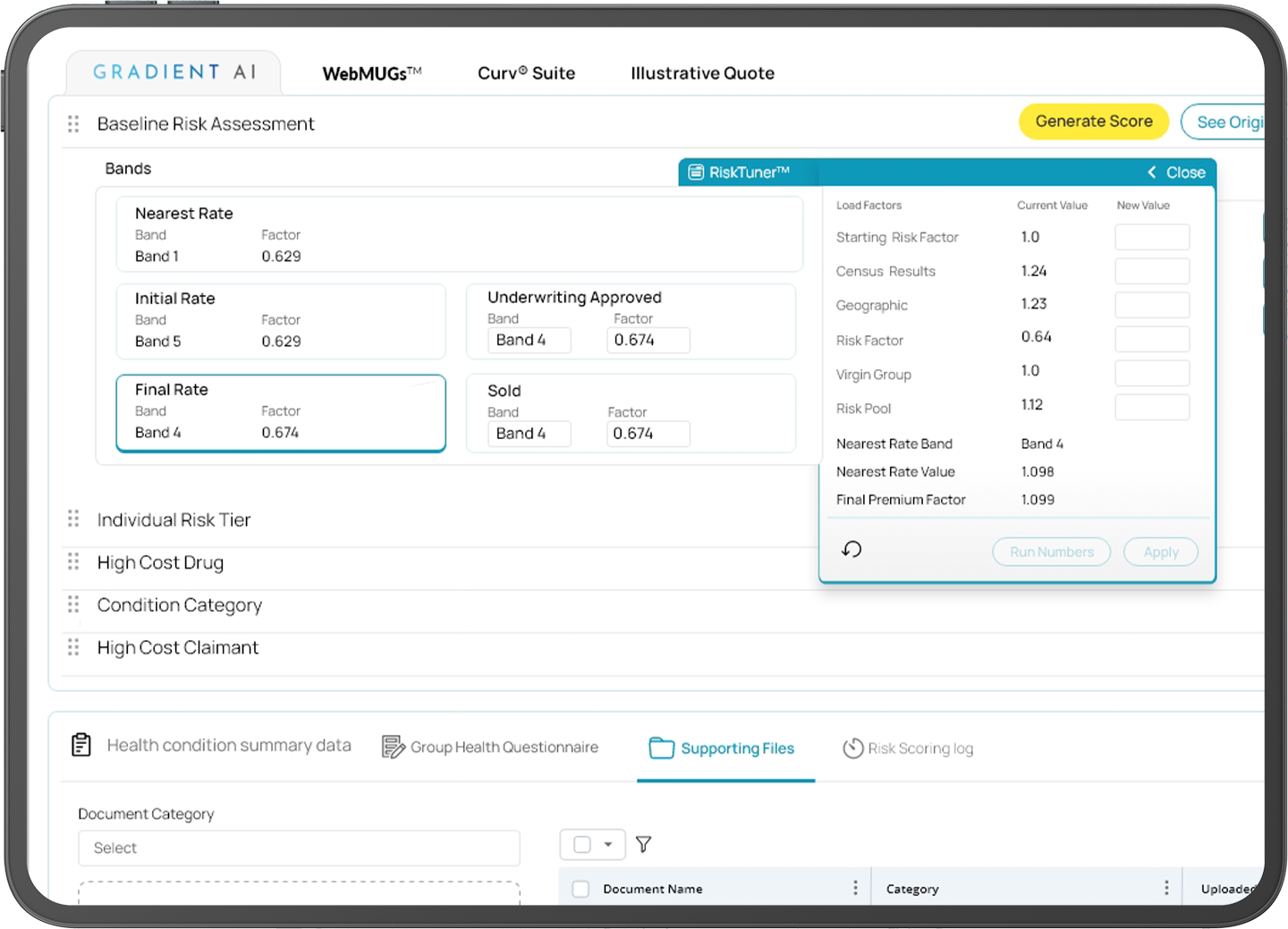

RiskTuner™

Offers tailored risk assessments for precise pricing and plan structuring.

Offers tailored risk assessments for precise pricing and plan structuring.

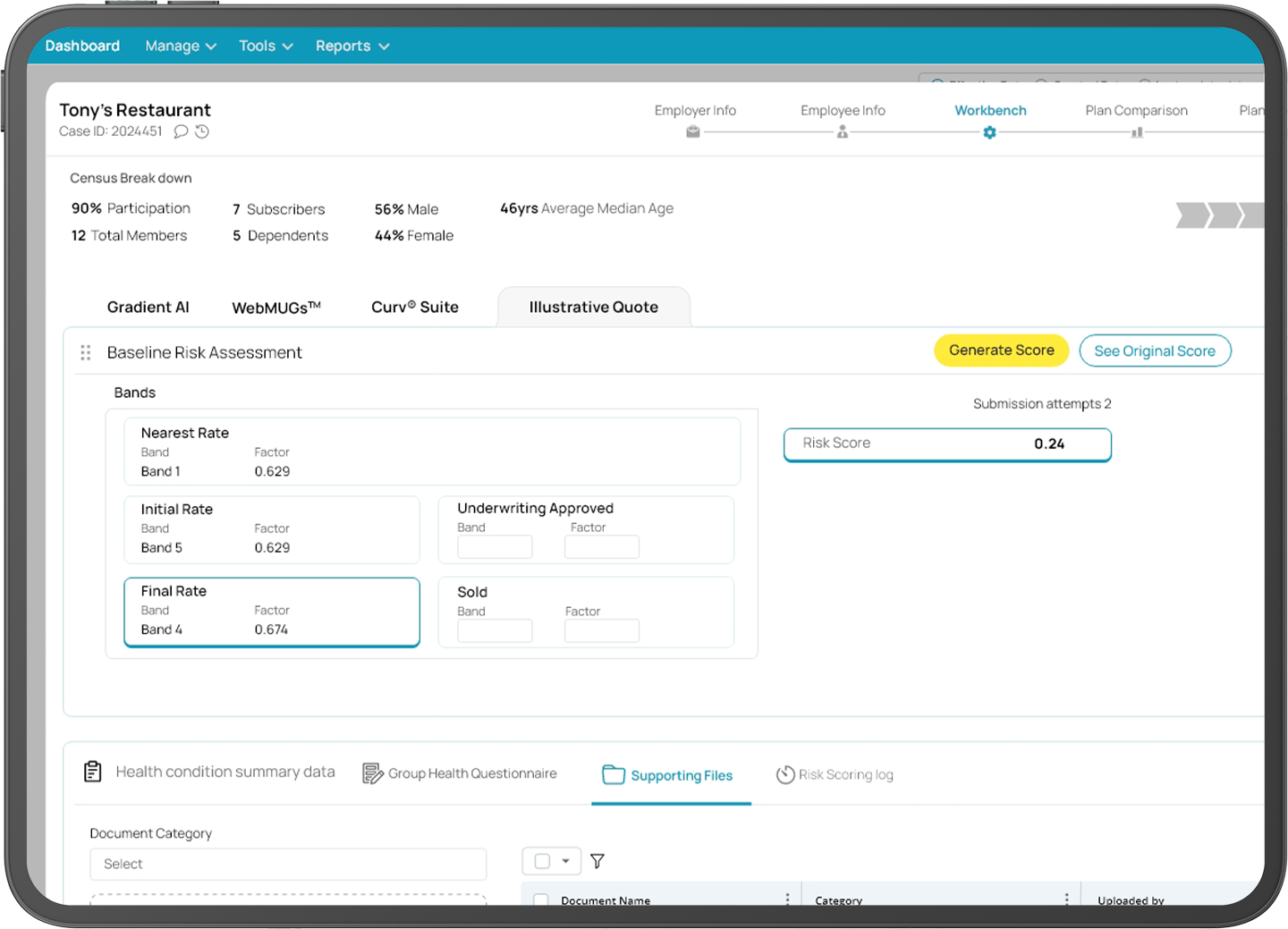

Illustrative Quoting Tools

Simplify plan comparison with engaging visuals, improving client and member understanding.

Simplify plan comparison with engaging visuals, improving client and member understanding.

Multi-Line Management

Seamlessly handle group health, ancillary, and other benefit lines across member organizations.

Seamlessly handle group health, ancillary, and other benefit lines across member organizations.

How DataHub Supports AHPs and MEWAs

Automated Workflows

SmartExtractor™: Automates the extraction and standardization of census and claims data, reducing errors and processing times.

SmartExtractor™: Automates the extraction and standardization of census and claims data, reducing errors and processing times.

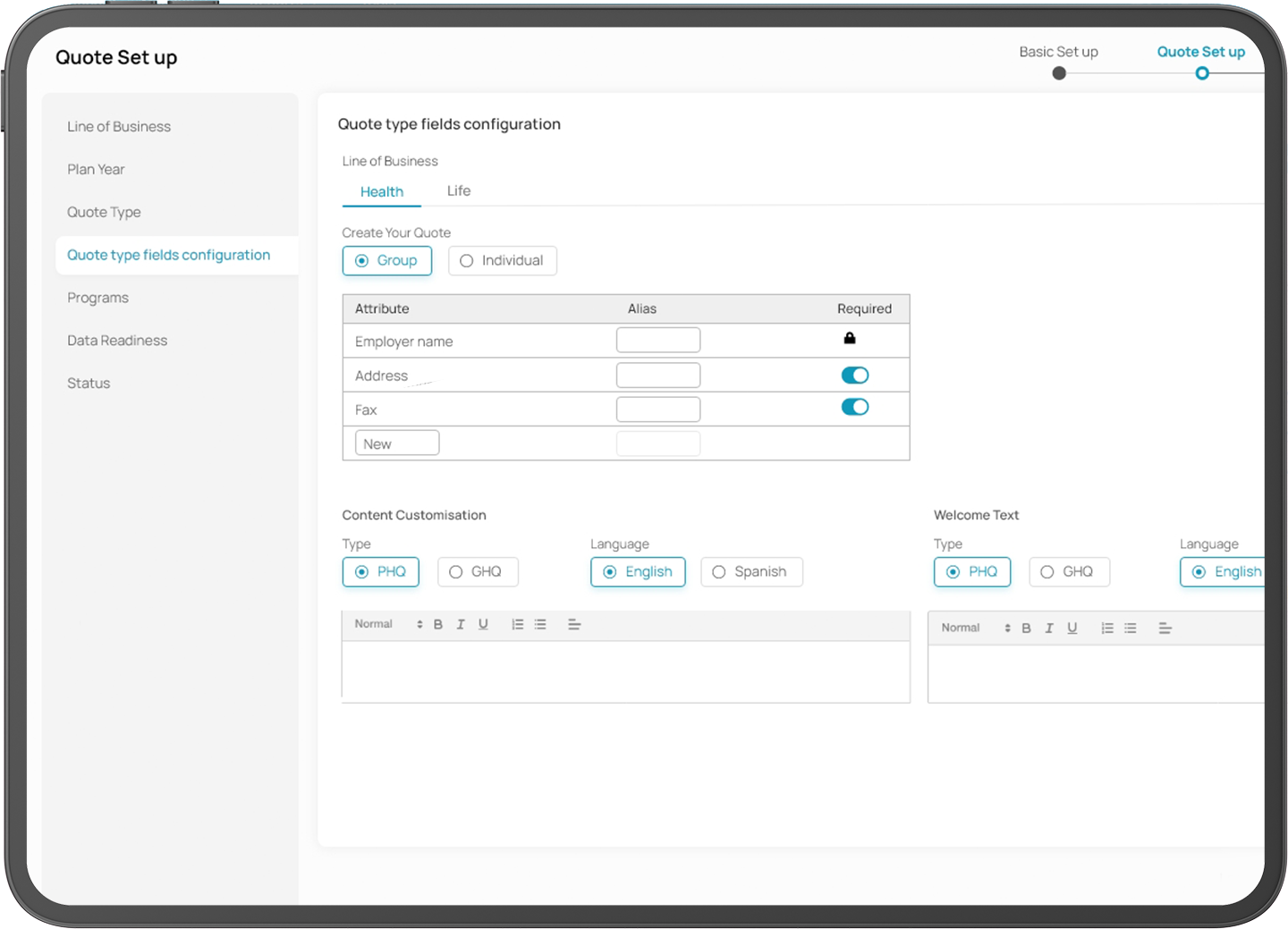

Automated Quoting and Plan Management: Supports efficient workflows for underwriting and tailoring benefit plans to meet diverse needs.

Automated Quoting and Plan Management: Supports efficient workflows for underwriting and tailoring benefit plans to meet diverse needs.

Unified Data Integration

Centralized Data Management: DataHub consolidates member organization information into one unified platform, improving visibility and accuracy.

Centralized Data Management: DataHub consolidates member organization information into one unified platform, improving visibility and accuracy.

Real-Time Updates: All stakeholders—brokers, underwriters, and payers—work with up-to-date, accurate data.

Real-Time Updates: All stakeholders—brokers, underwriters, and payers—work with up-to-date, accurate data.

Improved Collaboration and Transparency

Broker and Member Organization Integration: DataHub ensures smooth communication and collaboration between stakeholders.

Broker and Member Organization Integration: DataHub ensures smooth communication and collaboration between stakeholders.

Illustrative Quoting Tools: Visual tools simplify complex plan options, enhancing clarity and member trust.

Illustrative Quoting Tools: Visual tools simplify complex plan options, enhancing clarity and member trust.

Enhanced Compliance and Risk Management

SmartAudit™: Tracks compliance with multi-state regulations and ensures accurate adherence to all legal requirements.

SmartAudit™: Tracks compliance with multi-state regulations and ensures accurate adherence to all legal requirements.

RiskTuner™: Provides precise risk assessments for crafting tailored plan offerings, reducing risk exposure.

RiskTuner™: Provides precise risk assessments for crafting tailored plan offerings, reducing risk exposure.

Outcomes You Can Expect

80%

Reduction in Manual Data Entry Errors

50%

Faster Turnaround for Quotes

30%

Time Savings on Administrative Tasks

100%

Unified Data View

How Association Health Plans Are Leveraging the Shift

Research shows that Association Health Plans are playing a pivotal role in the shift to alternative funding models, offering member organizations the flexibility to provide competitive benefits while controlling costs. Tools like DataHub help AHPs rise to the challenge by reducing inefficiencies, improving collaboration between brokers and payers, and delivering tailored data-driven solutions that increase member satisfaction.

Simplify The Complexities Of Managing MEWAs And Association Health Plans

Schedule a demo today and see how DataHub can help streamline operations, improve accuracy, and enhance member satisfaction.