Transform Stop Loss Underwriting With Intelligent Automation

Stop loss carriers and MGUs face the dual challenge of managing high volumes of complex submissions and ensuring precise risk assessments in tight timeframes. DataHub transforms these workflows, integrating fragmented processes and leveraging AI to deliver faster, more accurate decisions while enhancing client satisfaction.

Challenges We Solve

Manual, Time-Intensive Processes

Complex claim evaluations and underwriting are slowed by manual data entry and validation.

Labor-intensive tasks drive up administrative costs and reduce efficiency.

Fragmented Data Systems

Disparate data sources hinder your ability to gain a unified view of submissions and risks.

Limited real-time data results in delays and missed opportunities.

Compliance and Transparency

Navigating multi-state regulations can complicate underwriting and risk pricing.

Lack of visibility into case status results in inefficiencies and reduces client trust.

Complex Risk Assessments

Assessing large volumes of claims manually increases the risk of errors.

Inconsistent workflows lead to inefficiencies and missed benchmarks.

Key Features for Stop Loss Carriers and MGUs

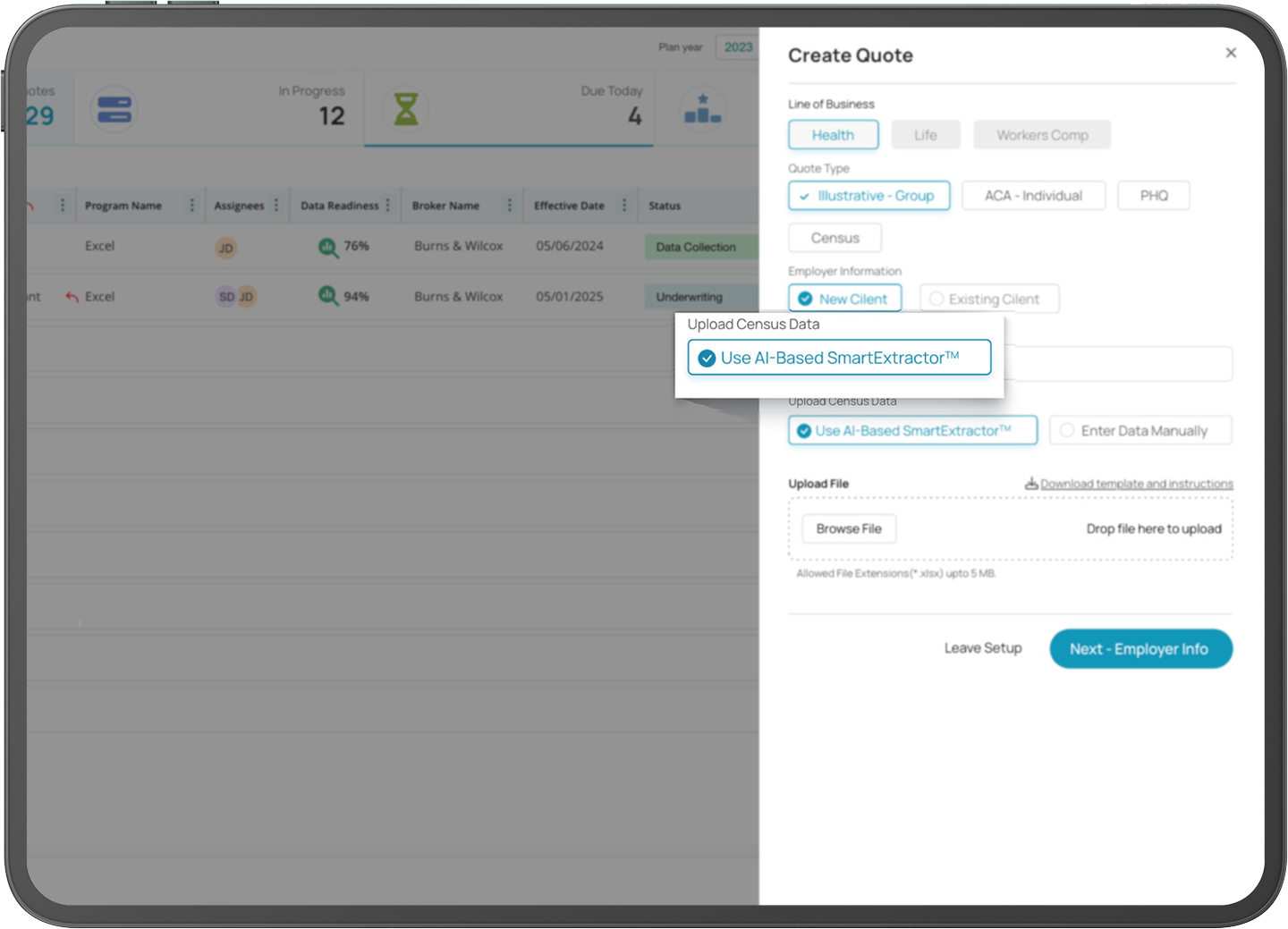

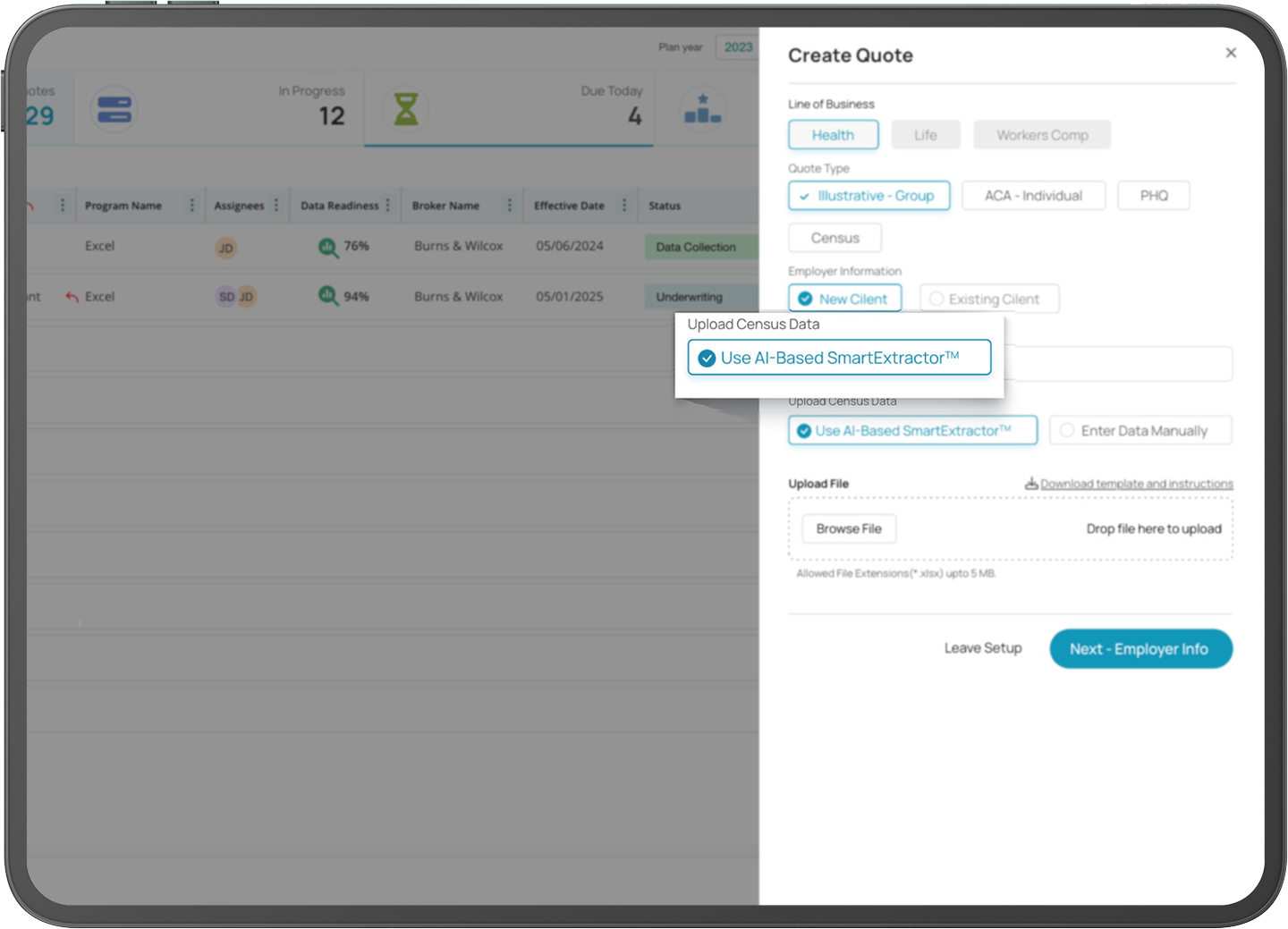

AI-Enabled SmartExtractor™

Automates data entry, ensuring faster and more accurate claim processing.

Automates data entry, ensuring faster and more accurate claim processing.

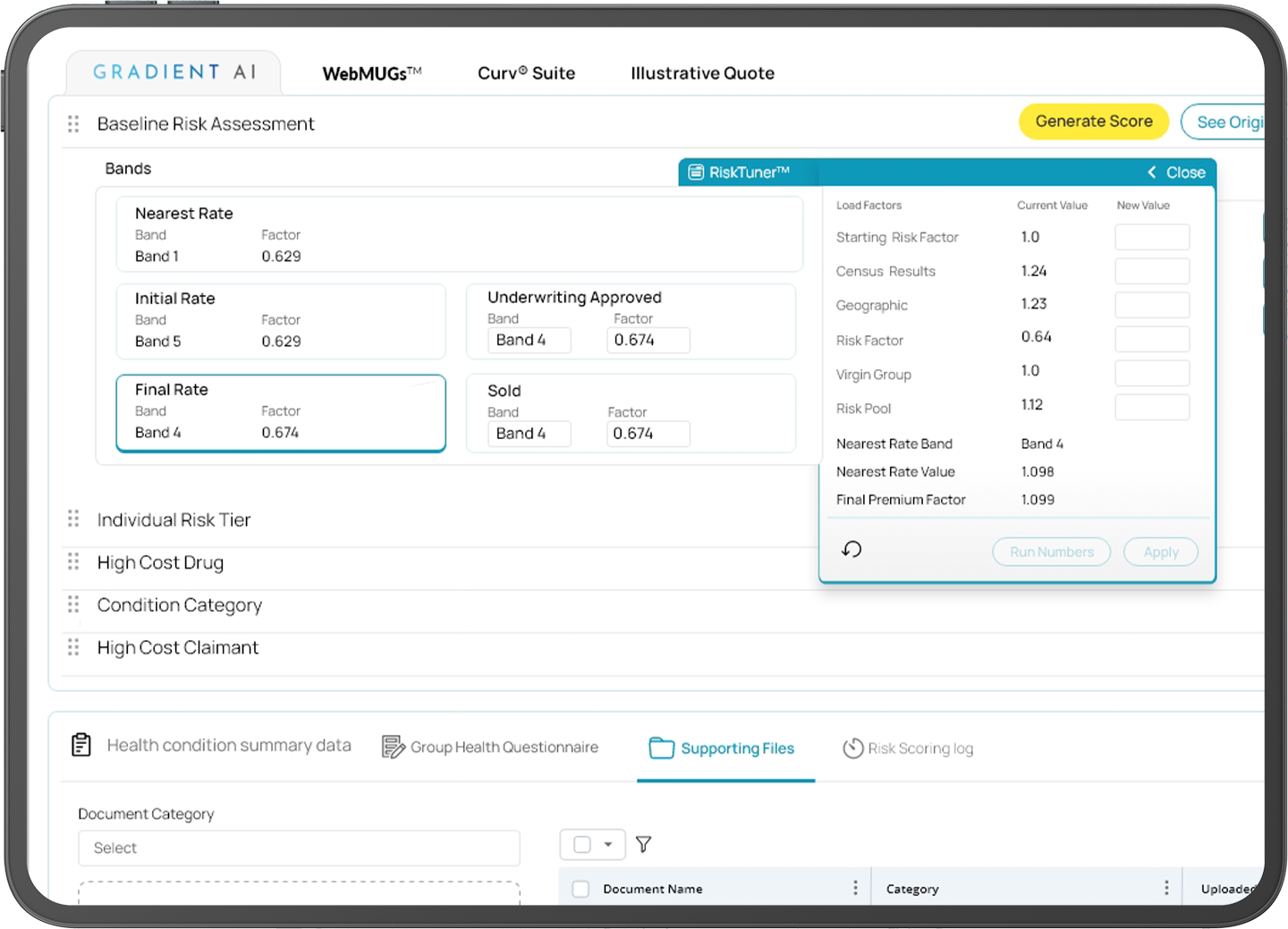

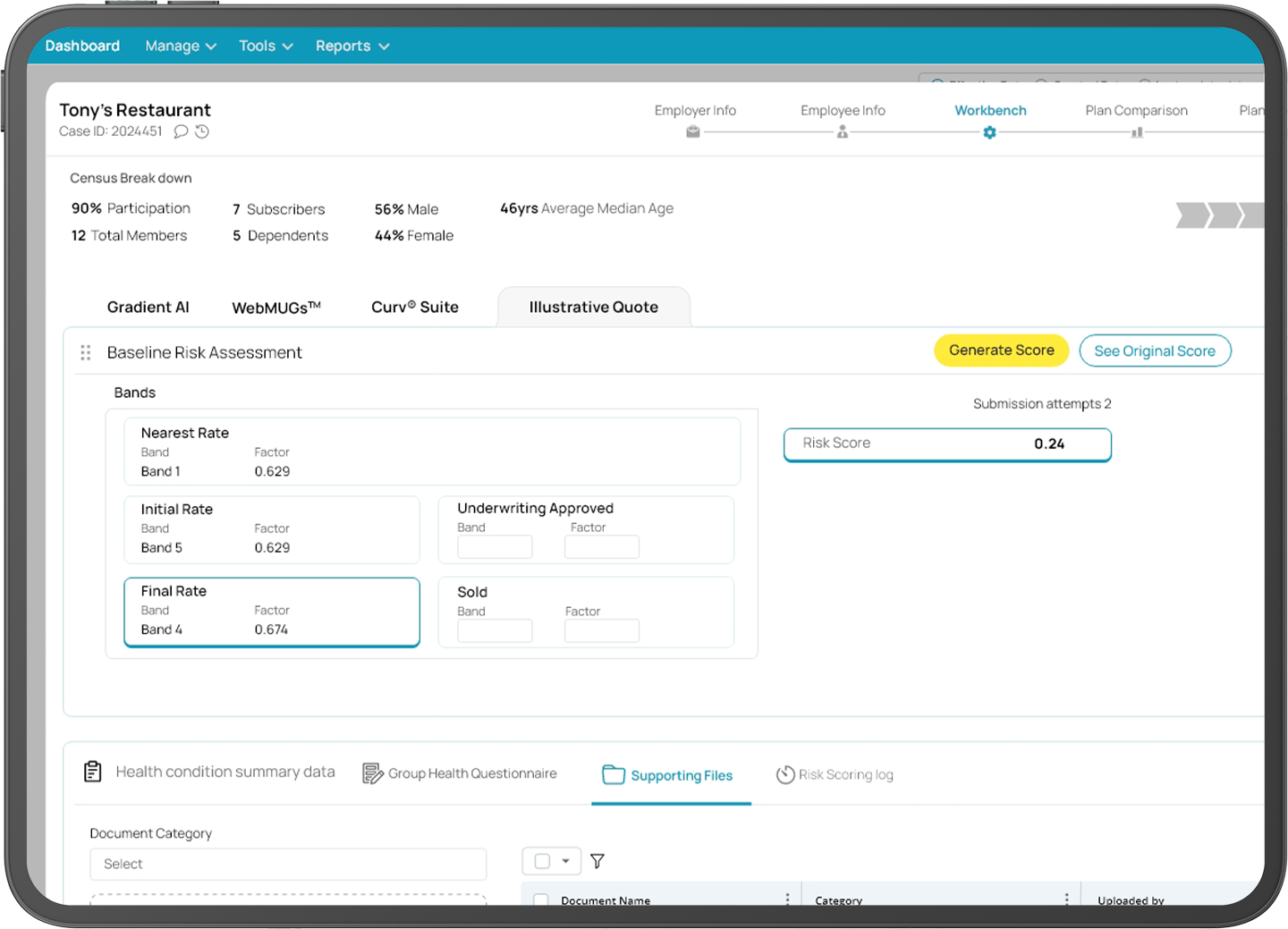

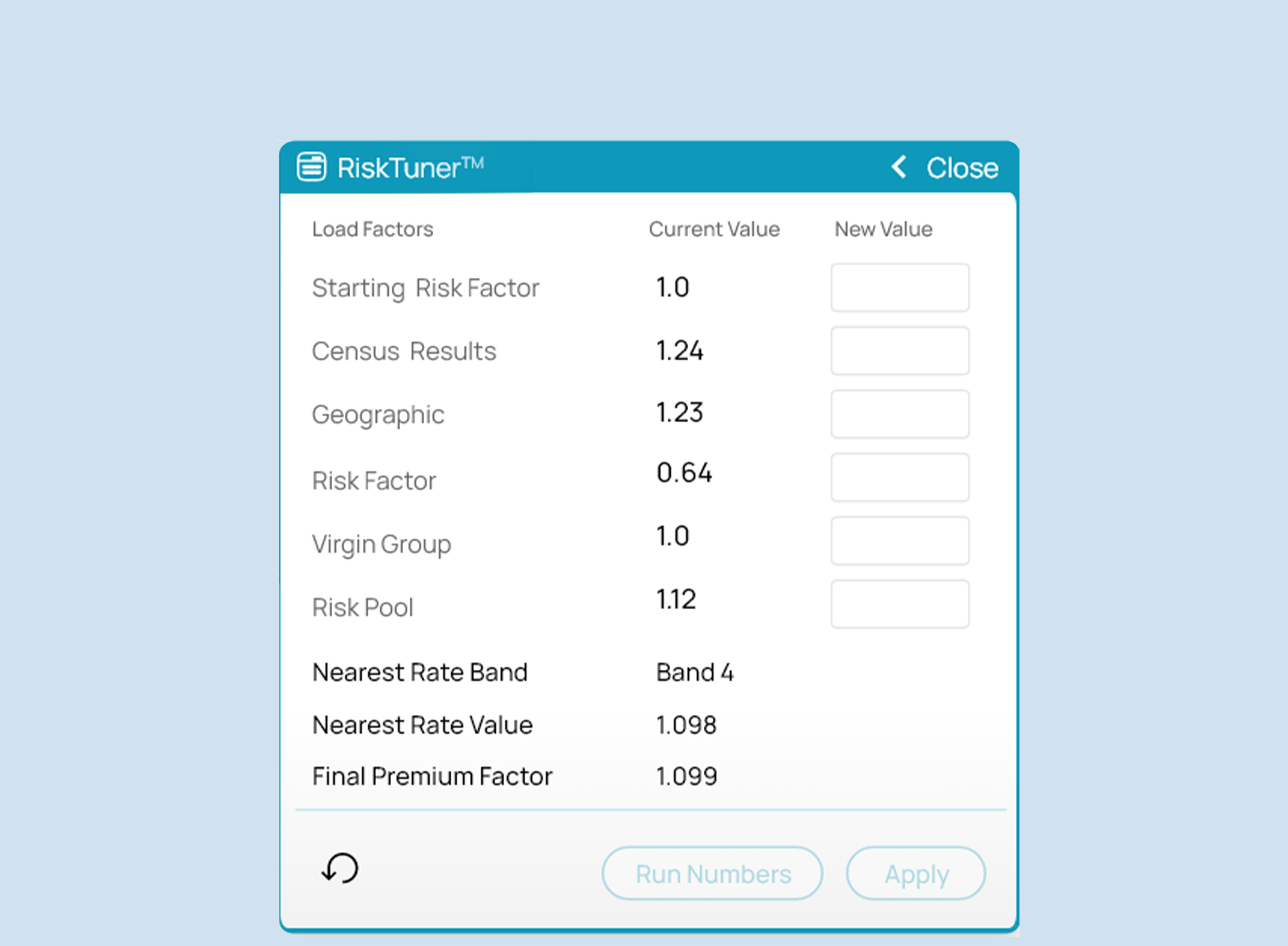

RiskTuner™

Delivers precise risk assessments tailored to stop loss and MGU needs.

Delivers precise risk assessments tailored to stop loss and MGU needs.

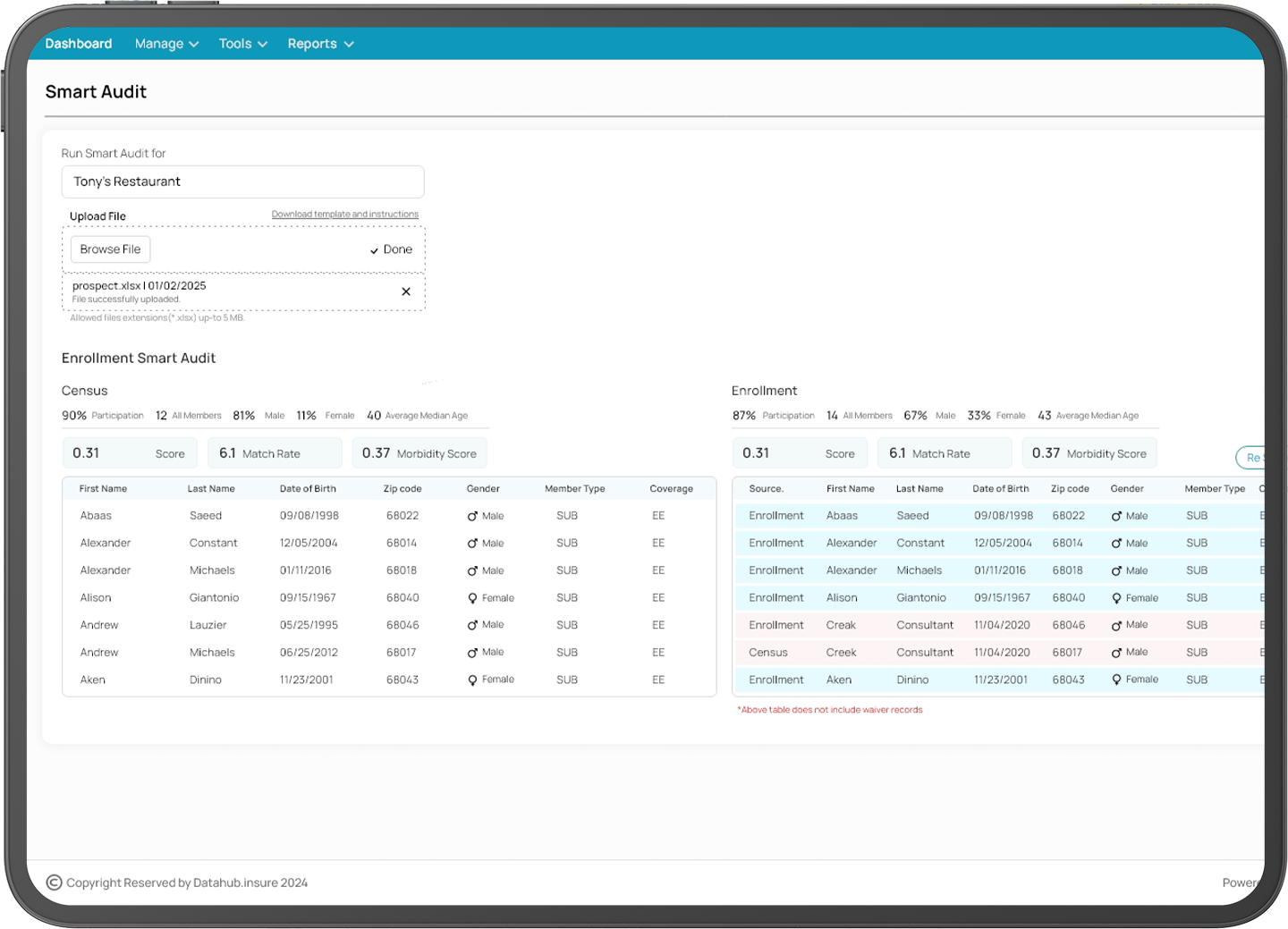

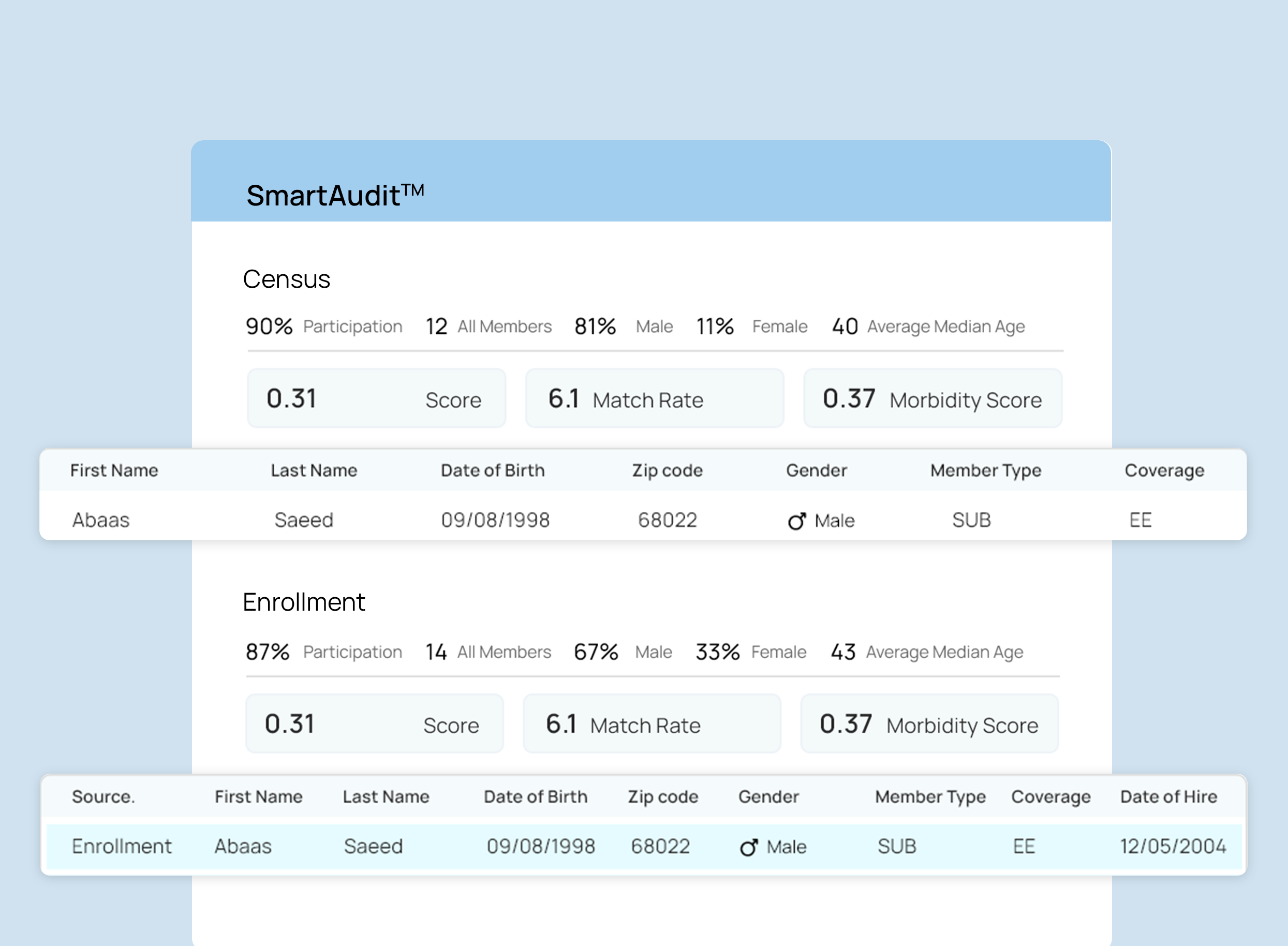

SmartAudit™

Ensures compliance with complex regulatory frameworks.

Ensures compliance with complex regulatory frameworks.

Portfolio Management

Centralized tracking and management of claims and risks across multiple clients.

Centralized tracking and management of claims and risks across multiple clients.

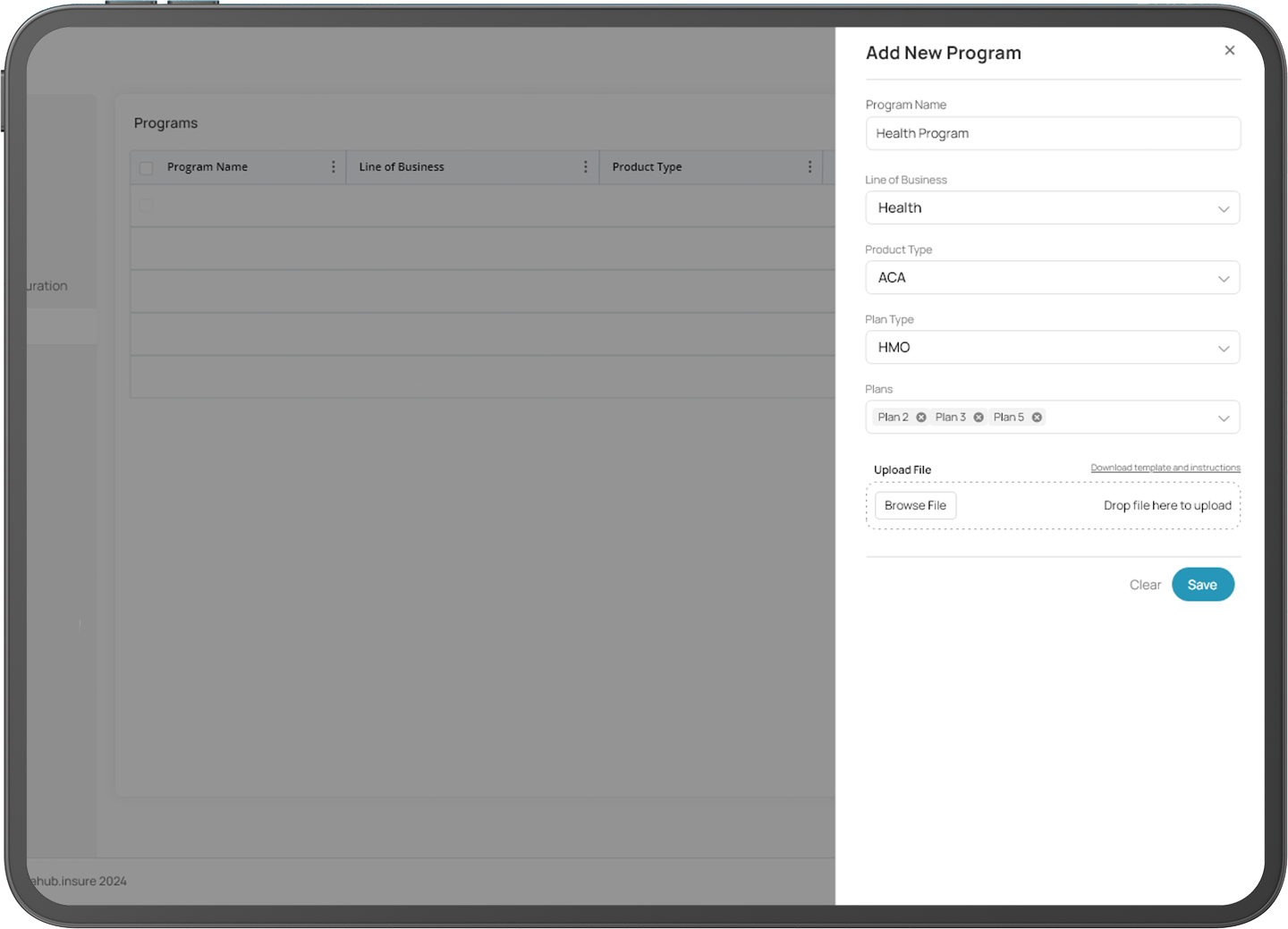

Multi-Line Management

Seamlessly supports diverse risk categories and stop loss structures.

Seamlessly supports diverse risk categories and stop loss structures.

Illustrative Quoting

Simplifies complex stop loss proposals with visual tools for clear client communication.

Simplifies complex stop loss proposals with visual tools for clear client communication.

How DataHub Supports Stop Loss Carriers and MGUs

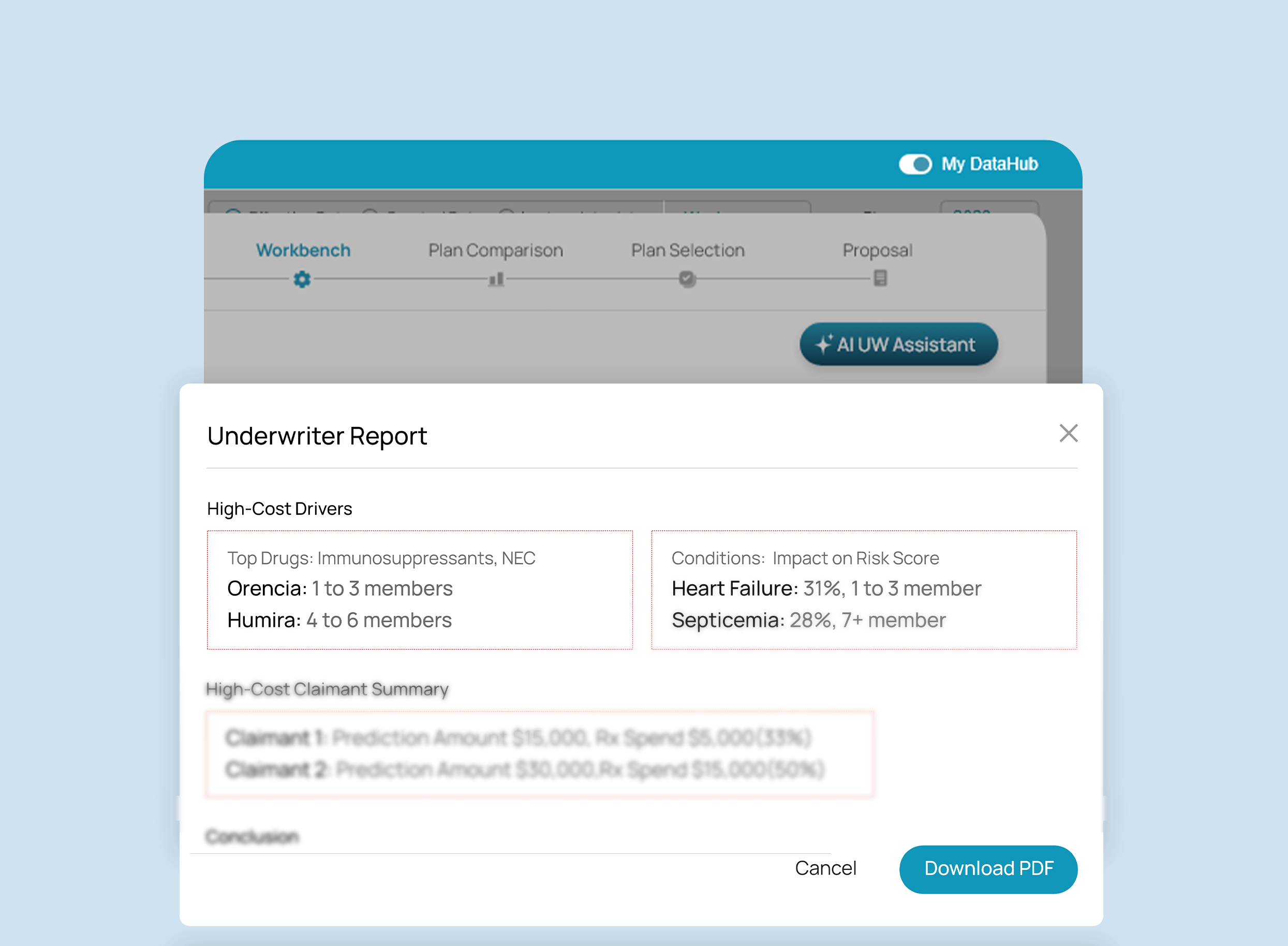

AI-Driven Underwriting & Risk Management

AI UW Assistant cuts through the noise, delivers concise summaries of high-cost claimant data and risk impact, enabling you to make informed decisions.

AI UW Assistant cuts through the noise, delivers concise summaries of high-cost claimant data and risk impact, enabling you to make informed decisions.

Reduces file review time by 60%, decreasing errors and streamlining underwriting for faster decisions.

Reduces file review time by 60%, decreasing errors and streamlining underwriting for faster decisions.

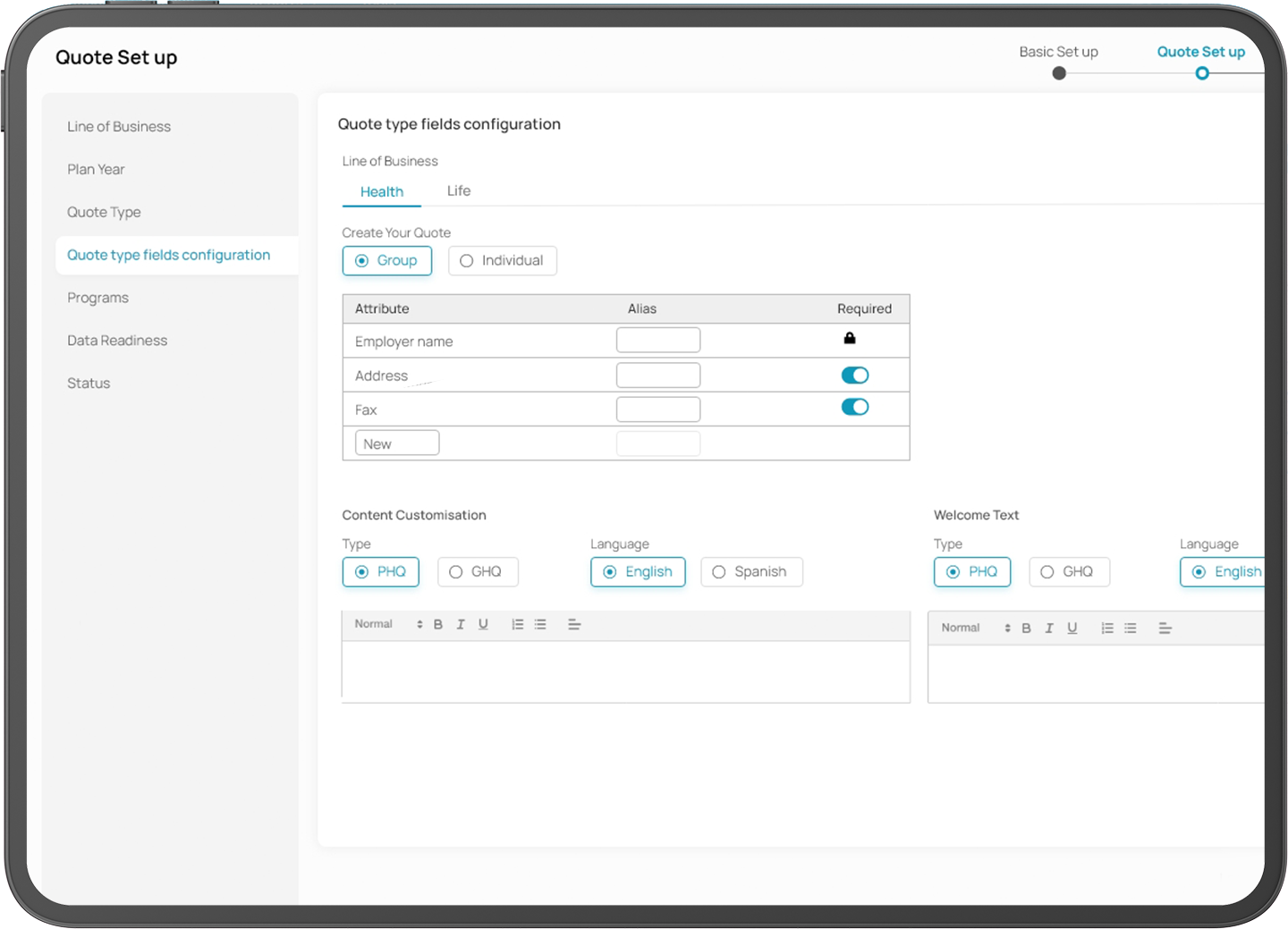

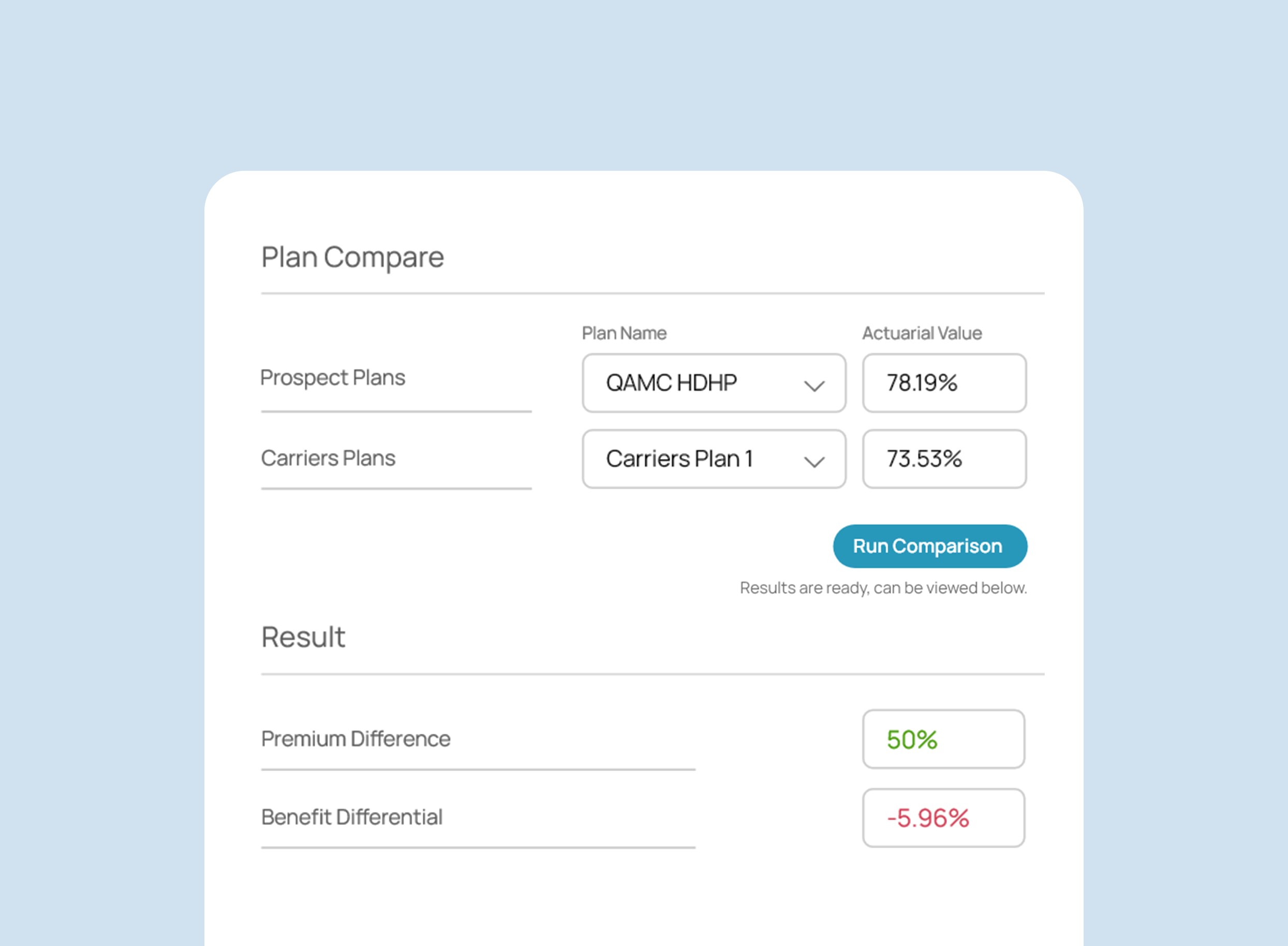

Comprehensive Plan Comparison Tools

Supports level-funded and self-funded plan comparisons to provide tailored recommendations.

Supports level-funded and self-funded plan comparisons to provide tailored recommendations.

Accurately evaluates premium, benefit, and network differences with automated actuarial tools.

Accurately evaluates premium, benefit, and network differences with automated actuarial tools.

Centralized Data Access

Unified dashboards integrate all submission, claim, and portfolio data for streamlined management.

Unified dashboards integrate all submission, claim, and portfolio data for streamlined management.

Real-time updates ensure accurate and consistent data for all stakeholders.

Real-time updates ensure accurate and consistent data for all stakeholders.

Enhanced Risk Assessment

RiskTuner™ enables precise, automated risk evaluations to guide confident pricing decisions.

RiskTuner™ enables precise, automated risk evaluations to guide confident pricing decisions.

Streamlined underwriting workflows ensure consistent, accurate, and timely quote generation.

Streamlined underwriting workflows ensure consistent, accurate, and timely quote generation.

Compliance and Visibility

SmartAudit™ ensures adherence to complex regulatory requirements across jurisdictions.

SmartAudit™ ensures adherence to complex regulatory requirements across jurisdictions.

Transparent workflows improve accountability, decision-making, and client trust.

Transparent workflows improve accountability, decision-making, and client trust.

Outcomes You Can Expect

40%

Faster Turnaround Times

50%

Improved Operational Efficiency

80%

Reduction in Data Entry Errors

25%

Higher Client Satisfaction

Ready To Transform Your Stop Loss And MGU Workflows?

Join the organizations that trust DataHub to streamline operations and deliver unparalleled value.